In today’s fast-paced entire world, making an investment in financial markets has developed into a preferred method to make wealth. However, navigating the sophisticated and volatile financial markets could be daunting, even for experienced traders. That’s in which Cfd trading can be purchased in. Cfd trading is really a well-known way to buy financial markets with out actually buying the underlying resource on its own. In this blog post, we will discover the nuances of Cfd trading and how it will help you are a smart trader.

1. What is Cfd trading?

CFD is short for Contract for Big difference. It is actually a popular fiscal derivative that allows dealers to speculate going up or tumble of the asset’s cost with out actually owning it. With Cfd trading, forex traders can business an array of asset sessions, which includes stocks and shares, indices, commodities, forex, and cryptocurrencies. CFDs allow investors to industry on border, which suggests they only have to put in a tiny part of the complete trading quantity. Cfd trading is actually a highly leveraged trading tool, which can cause better returns as well as failures.

2. Advantages of Cfd trading:

Cfd trading gives several benefits over conventional trading. CFDs let forex market to get into a wide selection of marketplaces, providing them with the flexibleness to get varied tool sessions. With CFDs, dealers could also go long (purchase) or simple (offer) with an resource, which implies they could benefit from both market upswings and downturns. CFDs offer leverage, which means investors can certainly make big trades with a small amount of capital. This can raise possible profits, but it’s essential to understand that it can also result in substantial deficits. Finally, Cfd trading is available 24/7, permitting traders to take advantage of market moves night and day.

3. The best way to Trade CFDs:

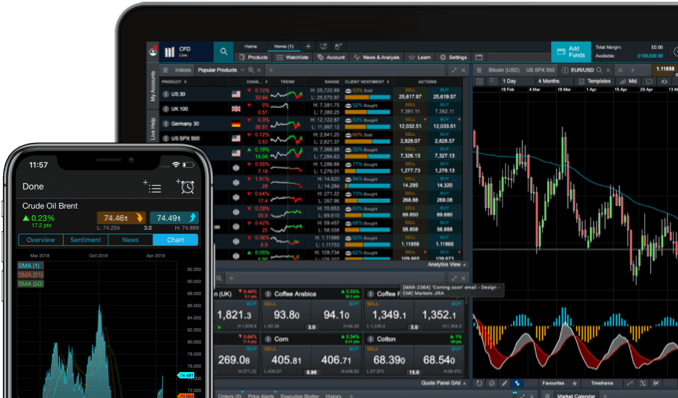

To get started on trading CFDs, you’ll must generate a merchant account by using a CFD agent. You’ll must offer some personal information and go through a verification procedure. When your account is to establish, you can start trading by depositing resources to your profile. Most brokerages provide trial credit accounts, letting you process trading with online funds just before risking real money. When you’re ready to business, you’ll should pick an focal point in business, decide if they should go long or simple, and find out your trading volume. Once you get into a trade, you are able to monitor your place via your trading platform.

4. Hazards of Cfd trading:

While Cfd trading may offer great returns, additionally, it incorporates high hazards. CFDs can be a leveraged trading instrument, which means that failures can exceed your initial put in. It’s important to possess a danger management method in place, for example setting cease decrease limits to reduce prospective deficits. Additionally, Cfd trading requires market volatility and needs a deep understanding of the markets you might be trading in. Without correct analysis and evaluation, traders can easily become a victim of loss.

5. In a nutshell

Cfd trading can be a well-known way to get a diverse selection of stock markets without buying the actual advantage. With its great influence and 24/7 accessibility, Cfd trading may offer considerable returns, but it’s also essential to have a seem danger managing strategy in place. By knowing the basics of Cfd trading, you are able to develop into a knowledgeable entrepreneur and take full advantage of market actions.