The forex market is a dynamic and exciting market. With trillions of dollars traded daily, it is the largest financial market in the world. With all of this activity, it is no surprise that charting and technical analysis are critical components of success in the Forex market. In this blog post, we will explore the topic of technical analysis and provide insights on how you can use it to chart your path to success.

1. What is technical analysis?

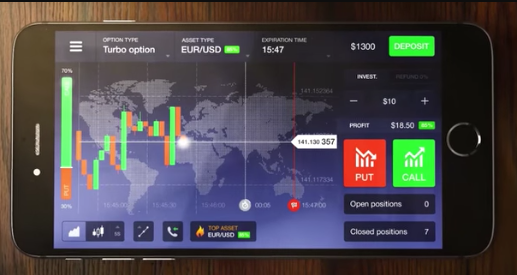

Technical analysis is the study of historical market data to identify trends and patterns. It involves the use of charts, technical indicators, and other tools to determine a market’s direction, momentum, and potential for price movements. Technical analysis is based on the premise that market trends, price patterns, and other factors repeat themselves over time and can be used to predict future price movements.

2. The importance of technical analysis in Forex trading

Forex traders use technical analysis to make informed decisions about when to enter and exit positions. By analyzing market trends and patterns, traders can identify potential opportunities for profitable trades. Technical analysis also helps traders to manage risk by identifying support and resistance levels, which indicate where prices are likely to reverse direction.

3. Types of technical analysis tools

There are many different types of technical analysis tools that traders can use. Some of the most popular technical indicators include moving averages, Bollinger bands, and MACD. Traders can also use chart patterns such as head and shoulders, triangles, and double tops and bottoms to identify potential trends and market reversals.

4. The art of charting

Charting is an essential aspect of technical analysis. Traders use charts to visualize market trends and patterns and to identify potential entry and exit points. Effective charting involves selecting the right time frame, choosing the right indicators, and understanding the market context. Experienced traders can use complex charting techniques to gain valuable insights into market behavior.

5. The benefits of technical analysis

The benefits of technical analysis are numerous. By using technical analysis, traders can identify potential opportunities for profitable trades, manage risk, and make informed decisions about when to enter and exit positions. Technical analysis can also help traders to spot trends and patterns that may not be evident from other sources. With consistent application, technical analysis can lead to improved trading performance and increased profitability.

Conclusion:

Technical analysis is a critical component of success in the Forex market. By studying market trends and patterns using charts, technical indicators, and other tools, traders can identify potential opportunities for profitable trades, manage risk, and make informed decisions about when to enter and exit positions. With consistent application, technical analysis can lead to improved trading performance and increased profitability. So why not start charting your path to success today?